By Mickey Ellinger and Marcy Rein

Organizing Upgrade

March 29th, 2021

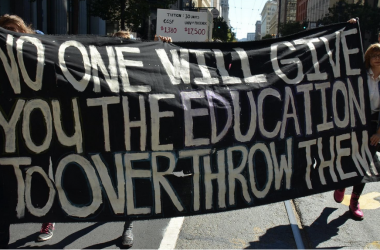

Rally in Philadelphia on Jan. 4, 2021 demanding that President Biden cancel all student debt on his first day in office. The action was co-sponsored by 10 organizations, among them the Debt Collective, Black Lives Matter Philly, Philly DSA, and the Caucus of Working Educators. Photo from the Pennsylvania Debt Collective.

Student debt weighs on the 45.3 million people and their families who have collectively borrowed $1.7 trillion to go to college. The burden presses most heavily on Black students and their families, who carry, on average, more than twice as much debt per student as do whites. Student loan debt is second only to mortgage debt and one-and-a-half times credit card debt. Eighty percent of student loans are made by the federal government – with taxpayer dollars.

Organizers have pushed campaigns for debt cancellation from margin to mainstream. They’re raising awareness of debt cancellation as an anti-racist action that would be an equality-supporting stimulus and narrow the racial wealth gap. Student debt can be canceled by President Biden under existing laws – but organizers will have to overcome resistance from Republicans and centrist Democrats alike to make that happen.

BLACK INDEBTEDNESS HAS A LONG HISTORY

Black students’ onerous debt load “follows a historic pattern in America, where Black people are given an opportunity only if they take on large debts,” said Dr. Jalil Mustaffa Bishop of the University of Pennsylvania Graduate School of Education. “Newly freed ex-slaves had to take on large debts to buy land and were often in debt to the people who had enslaved them. Voting was tied to a poll tax. Recent efforts to expand Black home ownership have led to Black borrowers being offered subprime loans,” said Bishop, who co-authored the NAACP’s comprehensive 2020 study on Black student debt.

BORROWING FOR COLLEGE

Before 1965, federal money went to institutions, especially public colleges and universities – although, the NAACP study noted, the bulk went to whites-only schools with only crumbs to historically Black schools. The Higher Education Act of 1965 shifted the burden of paying for college onto individuals. Instead of supporting institutions, the Act’s Title IV established financial aid to students through grants (Pell grants) and low-interest loans. President Lyndon Johnson compared families borrowing for college to taking out a mortgage to buy a home (at a time when redlining and discriminatory lending heavily restricted Black homeownership).

“Student loan programs provided the option for higher education to be funded, not as a public good, but as a private good to be individually financed,” the authors of the NAACP study wrote. Although the policy shift came at the height of the debate over civil rights legislation, “little research has been done to understand how race shaped the creation of student loan programs.”

In 1972 for-profit schools got in on the deal as Congress amended the Higher Education Act to offer government-backed loans to students in for-profit schools in addition to private and public ones. The economic value of a college education became a marketing tool, and students were encouraged to “invest in yourself” by getting a college degree, even if it meant going into debt. As costs rose across all colleges, debt rose with it.

Federal and state funding for public colleges and universities fell from almost $10,000 per student in 2000 to less than $7,000 in 2013. Tuition and fees rose, and more of the cost fell on students, who now pay almost 50% of the total. The price of public two-year and private nonprofit four-year colleges more than doubled between 1988-89 and 2018-19; in-state tuition at public universities nearly tripled.

In the 2000s, pricier for-profit schools expanded dramatically, with enrollment nearly doubling between 2006 and 2010. For-profit colleges are notorious not only for their cost, but for their aggressive – if not fraudulent – recruiting practices and dismal graduation rates. Students at these schools carry more debt and earn lower wages, according to a policy brief for the U.S. Department of Education by the Leadership Conference Education Fund.

For-profit colleges target Black students and other students of color in an eerie and infuriating parallel to the predatory mortgage lending that led to the financial crisis of 2008. “For-profit institutions deliberately exploit low-income people of color who are often more vulnerable to fraudulent marketing techniques because they are unemployed, underemployed, or otherwise searching for increased earning power,” the Leadership Conference Education Fund found. One-sixth of Black college students attend for-profit colleges; 98% of them are in debt.

More than $200 billion in student loans is owed to for-profits.

STUDENT DEBT BY THE NUMBERS

On average, student borrowers owe $37,691 each. Black bachelor’s degree holders average $52,000 in student loan debt. Black students account for fewer than 15% of college students but almost half of the borrowers. Ninety percent of Black college students borrow money (98% of Black students who attend for-profits), and Black students are the most likely to receive federal loans.

Forty-five percent of this debt is from student loans for graduate school: 40% of Black graduates have student loan debt from graduate school compared to 22% of white college graduates.

More than 50% of Black student borrowers report that their net worth is less than they owe in student loan debt. Four years after graduation, almost half of all Black students owe an average of 12.5% more than they borrowed. Black student borrowers are the second-most likely (after Native Americans) to have monthly payments of $350 or more.

LYING WITH STATISTICS

Earnings statistics are recited routinely to motivate students to get more education: “Men with bachelor’s degrees earn approximately $900,000 more in median lifetime earnings than high school graduates. Women with bachelor’s degrees earn $630,000 more. Men with graduate degrees earn $1.5 million more in median lifetime earnings than high school graduates.”

These statistics (from the Social Security Administration) justify student loans and serve as marketing material for the for-profit colleges.

But drilling down a little deeper reveals a different picture: for African Americans, more education actually widens the lifetime earnings gap with their white peers.

“African Americans and Latinos with Masters’ degrees have lifetime earnings lower than Whites with Bachelors’ degrees. Among African Americans, for example, lifetime earnings are 13-16 percent less than Whites with three prominent exceptions — less than high school (18% less than Whites), bachelor’s degrees (20% less than Whites), and Professional degrees (23% less than Whites),” the NAACP study found.

“Although I have a doctorate degree and well-paying career, my $220,000 student loan debt is debilitating and makes survival difficult,” debt-striker Richelle Brooks wrote. A single mother, she can’t pay high Los Angeles rents and cover her student loan payments. She and her children had to move in with her mother. “Homeownership is a dream of mine, but I’m fearful that will never be a reality for me,’ she said. “I am fearful, if things don’t change, that it won’t be a reality for my children either. That’s the way debt works. It affects entire families across generations, making it nearly impossible for Black women who are single mothers to leave anything but debt behind for their children.”

DO IT FOR THE ECONOMY, DO IT FOR JUSTICE

On the day of President Biden’s inauguration, the Center for Responsible Lending published a call, supported by 238 organizations, urging him to cancel federal student debt by executive action. A provision of the Higher Education Act allows the President to “enforce, pay, compromise, waive, or release any right, title, claim, lien, or demand, however acquired, including any equity or any right of redemption.”

Cancelling federal student debt was a campaign promise that Biden seems ready to break. He said cancellation would mostly benefit students borrowing a lot of money to go to elite colleges; this is either misinformed or just plain disingenuous. Rep. Alexandria Ocasio Cortez responded on Twitter: “Very wealthy people already have a student loan forgiveness program. It’s called their parents. The idea that millionaires and billionaires are willingly letting their kids drown in federal student loans and that’s why we can’t go big on forgiveness is about as silly as it sounds.” Not only that: cancellation serves both the economy and racial justice.

Canceling student debt would stimulate the economy. Ninety percent of student loan dollars are owed to the federal government. The Center for Responsible Lending estimates that “debt cancellation could boost real GDP by an average of $86 billion to $108 billion per year. Over the 10-year forecast, the policy generates between $861 billion and $1,083 billion in real GDP (2016 dollars).”

Canceling student debt would make a small but measurable improvement in the wealth gap between Black and white families, which widened to a chasm after the recession of 2008. An aide to Sen. Elizabeth Warren (D-Mass.) said canceling student debt would make the most significant strides toward narrowing the racial wealth gap since the civil rights movement.

Canceling student debt would be an act of reparations. The Movement for Black Lives calls for “Reparations for the systemic denial of access to high-quality educational opportunities in the form of full and free access for all Black people (including undocumented and currently and formerly incarcerated people) to lifetime education including: free access and open admissions to public community colleges and universities, technical education (technology, trade and agricultural), educational support programs, retroactive forgiveness of student loans, and support for lifetime learning programs.”

DEBT STRIKE!

One of the earliest campaigns to eliminate student debt was launched by the Debt Collective, formed in 2014 out of the energy of the Occupy movement. The Collective corrected the language from forgiveness (as if indebtedness was a crime) to cancellation and promoted debt strike as a tactic, arguing that while individual debtors are vulnerable, a movement to repudiate debt is powerful. Multi-millionaire J. Paul Getty is famously quoted as saying, “If you owe the bank $100, that’s your problem. If you owe the bank $100 million, that’s the bank’s problem.”

In its first debt strike, the Collective organized about 100 former students at schools in the for-profit Corinthian chain, amplifying their contention that they should not be responsible for debt to an institution that defrauded them. After more than a year of “negotiated rulemaking,” the U.S. Department of Education set a policy that canceled loans for some of the defrauded students – a process that was stalled under the Trump administration and just re-started in mid-March.

The Debt Collective seeks cancellation of the entire $1.7 trillion student debt in President Biden’s first 100 days and launched the “Biden Jubilee 100” campaign. One hundred strikers, among them Richelle Brooks, are refusing to pay.

“The fact is, I cannot pay this debt, and I shouldn’t have to. That’s why I have declared myself on strike, along with 99 others,” Brooks wrote. “We call ourselves the Biden Jubilee 100. I strike not only for myself and my children but for all Black women and their children weighed down by predatory, unjust debts. We, the Biden Jubilee 100, are on strike to demand full cancellation of all student loan debt and tuition-free college for all, to ensure that future generations don’t have to mortgage their futures for a chance to improve their lives, or just get by.”

The Debt Collective has called for a week of actions March 29 – April 4 to press for student loan cancellation.

Other organizations are advocating for student debtors using different means. These include the Project on Predatory Student Lending, which files suits on behalf of students who took out loans to attend for-profit colleges, and the Leadership Conference Education Fund and the Center for Responsible Lending, which are calling for changes in Department of Education rules. Among the 238 organizations who signed onto the Center’s Inauguration Day letter are labor and racial justice groups, professional associations and community organizing networks. And while there’s broad consensus on the need for debt cancellation, many groups also agree on the next step. From Justice Democrats to the Movement for Black Lives and the Red Nation, they call for free public higher education, open to all.