by Kanchan Sarker

Socialist Studies

The University of British Columbia, Okanagan

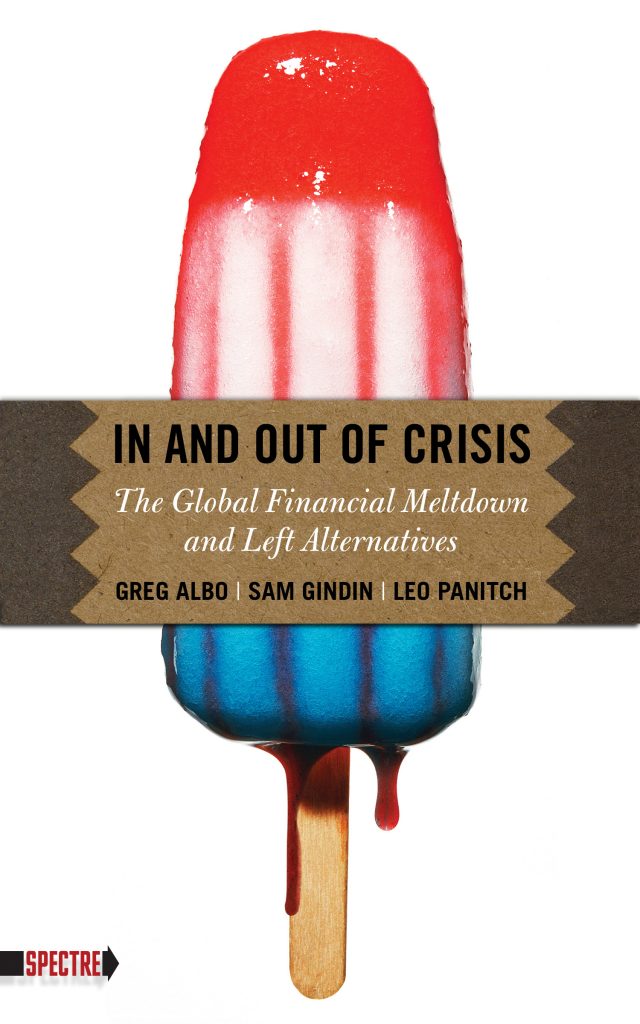

Among the many books on the contemporary economic crisis, In and Out of Crisis

is in a class of its own. Three prominent scholar-activists have teamed

up to provide an insightful and provocative analysis of the crisis and

its implications for the future of neoliberalism, the American empire

and the North American Left. In doing so, this new book picks up themes

common to Panitch and Gindin’s on-going work on the American empire and

Albo’s research on neoliberalism.

This is a concise, relatively accessible book, which presents a robust political intervention into current political economy and strategic debates on the Left. It begins with a concise history of the history of financial crises, state management of crises, the rise of neoliberalism and financialization. It then moves on to provide a detailed history and analysis of the current financial crisis and the American state’s role in managing and containing the crisis. Along the way, the authors also provide a chapter focused on the sweeping restructuring in the North American auto industry. Overall, Albo et al. argue that some key points which the Left has historically tended to poorly theorize (such as the relation between state and market, deregulation and neoliberalism, and American imperialism) have weakened the Left’s analysis and response to the current crisis.

To appreciate the specificity of their approach to theorizing the crisis, it is useful to carefully identify what is distinct, if not necessarily 186 unique, and notable in their analysis. First, the authors argue that the crisis was primarily a crisis within the American financial system. The dramatic growth of securitized sub-prime mortgages, which comprised 60 percent of the American market for asset backed securities, meant that the whole financial system became extremely vulnerable to the volatility in this segment of the market. This financial crisis, unlike some stock market crashes, became a general economic crisis because of its specific locus in the housing sector and the centrality of that to consumer spending. The global reach of the crisis was due to both the global circulation of complex financial assets based on consumer mortgages but also due the global importance of the American consumer market. The authors insist that this was not a crisis rooted in a profitability decline in the sphere of production.

However, as they outline in chapter five, the North American auto sector (the big three, if not the foreign transplants) was the one sector of the economy that was in crisis before the recession. Second, in a related point and contrary to some other Left theorists, Albo et al. argue that neoliberalism had succeeded, at least on its own terms (generating modest economic growth while maintaining low inflation thus reviving corporate profitability) after the crisis of the 70s. They refer to the dynamic nature of capitalism under neoliberalism (unlike those, such as Robert Brenner, who refer to a long downturn or depict the period since the 70s as one largely of stagnation and financial speculation).

In part, this dynamism was due to the

very success of financial capitalism, unstable as it is. Again contrary

to many on the left, these authors argue that financial innovation was a

key part of capitalist dynamism over the past thirty years or so,

rather than being mere speculation, or working at cross purposes to the

“real” economy. This new age of finance played a central role in

disciplining and integrating labour into markets as workers, consumers,

investors (particularly of pension funds), borrowers, and

home-owners.

Third,

they argue that the massive budget stimuli, state bailouts of financial

and manufacturing, and talk of re-regulation do not represent a shift

away from neoliberalism. Albo et al. forcefully insist that many on the

left have misunderstood neoliberalism as the withdrawal of the state.

This is a misunderstanding of the relationship between states and

markets.

Instead, they explain that “capitalist markets and

capitalist states are deeply intertwined in the class and power

structures of global capitalism” (10). The fundamental relationship

between capitalist states and financial markets cannot be understood in

terms of how much or little regulation the former puts upon the latter.

It needs to be understood in terms of the 187 guarantee the state

provides to property. “Neoliberalism should be understood as a

particular form of class rule and state power that intensifies

competitive imperatives for both firms and workers, increases dependence

on market in daily life and reinforces the dominant hierarchies of the

world market, with the U.S. at its apex” (28). The authors point out

that “Neoliberalism brought a change in the mode of regulation, but

there wasn’t less regulation. Moreover, freer markets often require more

rules” (35).

Fourth, just as reports of the death of neoliberalism have been greatly exaggerated, the crisis does not represent the end, or significant weakening, of the American empire. Albo et al. go so far as to suggest that the crisis “confirms U.S. imperial leadership” (86). The imperial relationships that built today’s global capitalism have persisted through the crisis.

Finally, Albo et al. paint a particularly bleak picture of the contemporary North American left as weak, defensive, defeated, marginalized, and lacking organizational coherence. As they note, “Competition…fragmented the working class. It eroded their one ultimate strength — solidarity” (79). The various challenges currently facing the Left are analyzed critically and comprehensively. The decline in trade union membership due to the neoliberal offensive as well as sectoral change of economy has put the trade union movement on the defensive. They place the labour movement at the centre of left politics analysis but in doing so they stress the need for the renewal of the labour movement. Unions need to reinvent themselves by adopting various tactics like “living wage” struggles in alliance with community organizations (96). Arguing that the labour movement can not lead the struggle for social transformation, the authors remain supporters of the need for a socialist political party. On the policy front, among other bold declarations, they call for the nationalization of the banking sector and its transformation into a public utility.

Perhaps not all readers will be convinced by their arguments about the continuing strength of neoliberalism and American economic leadership but their evidence is compelling and provides a useful reminder not to, once again, prematurely pronounce the end of American hegemony.

The authors’ arguments and analysis

are nicely summarized in the “Ten Theses on the Crisis” in the

concluding chapter. With all its propositions the book could be

considered a manual for the contemporary Left. An economic crisis

combined with wishful thinking is insufficient to defeat neoliberalism.

The missing variable is an organized, visionary and militant

working-class movement.

Back to Greg Albo’s Author Page | Back to Leo Panitch’s Author Page | Back to Sam Gindin’s Author Page